In a profit - making business the income and expenditure Account is generally called a Profit and Loss Account, but in a non-profit making business such as a cooperative society, the term "Income and Expenditure Account is more appropriate

Note: That the income and expenditure is similar in form to the Profit and Loss Account. They are both used to ascertain the Net surplus of a business or organization for a certain period. They are also prepared in the same manner. The only difference is the nomenclature. So if you can prepare a Profit and Loss Account, you can also prepare an income and expenditure account. All you have to do is to change the name of the account to income and Expenditure Account and debit all those items which ought to be debited in a Profit and Loss Account and credit all those items which ought to be credited in a Profit and Loss Account.

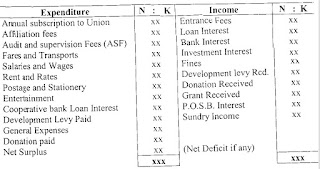

Specimen of an Income and Expenditure Accounts

Income and Expenditure Account of NOUN Cooperative Society Ltd. For the Period Ended 31st March 2003

This is treated the same way with a Net surplus derived from Profit and Loss Account. The Net surplus is either appropriated or carried to the balance sheet at the date when the books are closed. If there is a deficiency, the deficiency (Loss) is carried to the asset side of the Balance Sheet.

This account does not apply to the accounts of the Sole Trader. The various Cooperative Societies Laws make provisions for the appropriation of Surplus. Allocations made under these provisions are known as authorized allocations and therefore do not require the consent of members. The cooperative Laws of each State in Nigeria provides that 25% (i.e one quarter) of the Surplus of a Cooperative Society must be allocated to a reserve Fund, between 5% - 10% of the Surplus will be allocated to the Education Fund.

Apart from the statutory allocations, all other allocations of Surplus must be made with the consent of members.

OBJECTIVES

At the end of this unit, you should be able to:- describe this account as the equivalent of Profit and Loss Account

- transfer the balances from the Nominal accounts in the ledger to this income and expenditure account

- ascertain the correct Net Surplus or Net Loss (Net Profit or Net Loss) for a certain period

- show the treatment of the surplus of income over expenditure in accordance with the cooperative Laws and Regulations.

MAIN CONTENT

FINAL ACCOUNT II - Income and Expenditure Account, and Proposed Profit and Loss Appropriation Account (or Surplus Appropriation Account)- Explanation of Income and Expenditure Account :This may be described as the equivalent of Profit and Loss Account drawn up for Non-trading concern. It performs the same function with the Profit and Loss Account and is compiled and constructed on the same principles. It is a Nominal Account recording losses and expenses on the debit, and gains on the credit. Like the Profit and Loss Account, all expenditures relating to the period both paid and accrued are recorded on the debit side, while the credit side receives all incomes relating to the period whether actually received or not. The balance of the income and expenditure account shows the excess of income over expenditure (Net Surplus) or deficiency of income over expenditure (Net Loss).

Note: That the income and expenditure is similar in form to the Profit and Loss Account. They are both used to ascertain the Net surplus of a business or organization for a certain period. They are also prepared in the same manner. The only difference is the nomenclature. So if you can prepare a Profit and Loss Account, you can also prepare an income and expenditure account. All you have to do is to change the name of the account to income and Expenditure Account and debit all those items which ought to be debited in a Profit and Loss Account and credit all those items which ought to be credited in a Profit and Loss Account.

Specimen of an Income and Expenditure Accounts

Income and Expenditure Account of NOUN Cooperative Society Ltd. For the Period Ended 31st March 2003

Treatment of Surplus of Income over Expenditure

This is treated the same way with a Net surplus derived from Profit and Loss Account. The Net surplus is either appropriated or carried to the balance sheet at the date when the books are closed. If there is a deficiency, the deficiency (Loss) is carried to the asset side of the Balance Sheet.

Proposed Profit and Loss Appropriation Account

In cooperative organizations, the Net Surplus transferred to the Profit and Loss Appropriation Account. The aim of this account is to show the disposal If the Surplus (profit) of the society for the current financial period. The proposed Appropriation must be in accordance with the cooperative Law and Regulations.This account does not apply to the accounts of the Sole Trader. The various Cooperative Societies Laws make provisions for the appropriation of Surplus. Allocations made under these provisions are known as authorized allocations and therefore do not require the consent of members. The cooperative Laws of each State in Nigeria provides that 25% (i.e one quarter) of the Surplus of a Cooperative Society must be allocated to a reserve Fund, between 5% - 10% of the Surplus will be allocated to the Education Fund.

Apart from the statutory allocations, all other allocations of Surplus must be made with the consent of members.

These allocations are creditedto the relevant accounts. After meeting all the statutory provisions, the remaining surplus be return to the members that made them possible in accordance with the services rendered or patronage made by them. This could be achieved through some non statutory allocation listed below:

Note: That reserve fund is part of allocation of surplus of a registered cooperative society to meet unforeseen contingencies. It is created only if there is surplus, in other words 'no surplus, no Reserve fund'. It is a way of plugging back part of the surplus of the society while making provisions for a rainy day.

Also note that Education find is for continuous education of members and is also for the prevision of cooperative awareness to the men-ibers and general public. This could be achieved through seminars, symposia, trainings, film shows etc. These programmes are expected to be met from Education fund.

General Reserve: Any balance left from the Net Surplus is passed into this account.

- Bonus on patronage

- Interest on share capital

- Committee Bonus

- Secretary honorarium

- Provision for Entertainment

- General Reserve e.t.c

Note: That reserve fund is part of allocation of surplus of a registered cooperative society to meet unforeseen contingencies. It is created only if there is surplus, in other words 'no surplus, no Reserve fund'. It is a way of plugging back part of the surplus of the society while making provisions for a rainy day.

Also note that Education find is for continuous education of members and is also for the prevision of cooperative awareness to the men-ibers and general public. This could be achieved through seminars, symposia, trainings, film shows etc. These programmes are expected to be met from Education fund.

General Reserve: Any balance left from the Net Surplus is passed into this account.

Social Plugin