Domiciliary account is simply a foreign currency dominated account which you can use to transfer money abroad or within or initiate a wire transfer transaction. Most Nigerians domiciliary accounts are domiciliary account are dominated in dollars.

With a domiciliary account, you can easily transfer fund from one domiciliary account to another either through internet banking or standing order transaction and this days it can also be done through mobile banking, you can also withdraw your fund at any time at any GTbank location nationwide. You can fund your domiciliary account with travellers check, international check lodgement or by direct deposit at the bank with your foreign currency at hand. good to know APN, Proxy Server Address and Dial Numbers for MTN, Airtel, Glo and Etisalat Internet Manual Configuration

So what are the requirements in opening a GTbank domiciliary account?

We all know that time flies and changes as we all know is the only thing that is considered permanent in this life. What you used to open your GTbank domiciliary account last year or previous years might not be what you will use to open it today. The things that you are required to have on ground are;= => Minimum open balance of $200. Before it used to be $100, but now most branches of GTbank will demand for $200. Don’t worry about that much, if you can borrow that, just go ahead and borrow because after you have successfully opened your account, you can easily withdraw it back at any time and pay back your lender.

= => at least two passport photographs will suffice.

= => copies of acceptable means of identification, preferably copies of your driver’s licence or international passport or national identity card. Just one of them

= => a copy of utility bill issued in not more than three months ago. This can be PHCN bill, telephone bill etc.

= => two persons as referee that will fill each of the two reference forms that will be issued to you. Your both referees need to have a current account each preferably with GTbank to facilitate the process.

With the above items in place, you are good to go. The next step will be for you to head straight to any branch of GTbank in your location

= => locate the customer service of that branch and request that you want to open a domiciliary account with them.

= => you might be asked if you already have a current account or savings account with them. If you already have a current account with them, then good and fine, if not they will open one for you together with you domiciliary account.

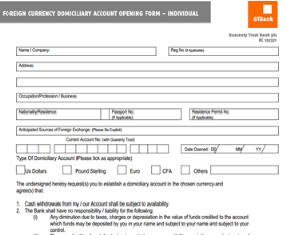

= => you will then be issued a Foreign currency account opening for, a specimen signature form and two reference forms for you and your referee to fill.

= => since your referees might not be present with you at this moment, you can decide to take all the forms home, fill them accordingly and give your referees each of the reference form to also fill accordingly and remember as I mentioned above they should both have current account already with GTbank preferably.

= => when you are done filling the forms, you can now head back to the bank will all your requirement mention above.

= => They customer care attendants will receive the filled forms from you and the necessary requirement, glance through it and will provide a kind of virtual account number for you since the account is new and then ask you to go and deposit the $200 with it.

= => After the necessary checks have been done, they will ask you to go and come back maybe in the next 48hrs for you to come and collect your original account number.

When you return and collect your account number, at this point, you are now a GTbank domiciliary account holder and you are entitled to any of the benefits that come with it.

Note: if you are like me, and with the entire requirement mentioned above in place, you can easily download the forms here, print them and fill them at home immediately or even initiate the opening process online before even heading to the bank at first place. This can save you a lot of time and stress and might prevent you from going to the bank twice or even thrice throughout the process.

Social Plugin